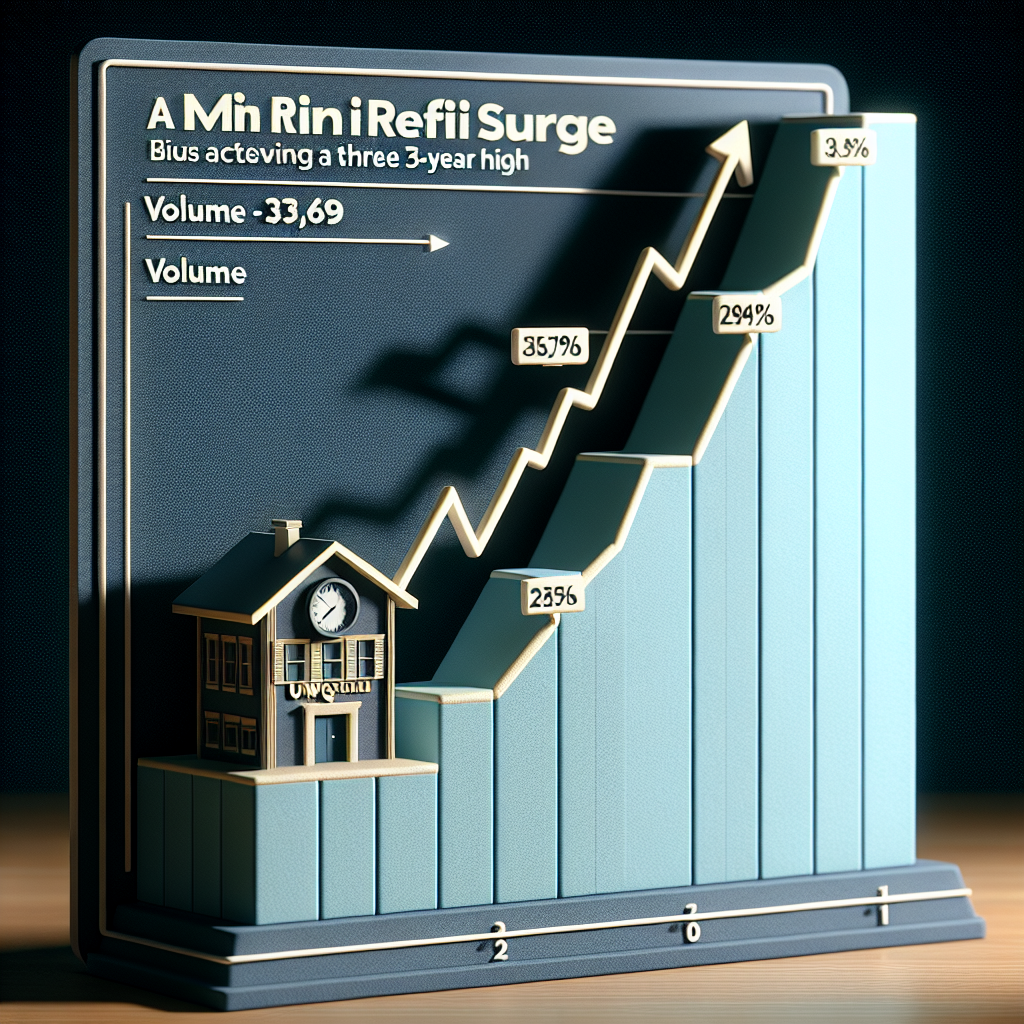

UWM Achieves Three-Year High in Volume During Mini Refi Surge

UWM Achieves Three-Year High in Volume During Mini Refi Surge

Introduction

United Wholesale Mortgage (UWM) has reached a significant milestone, achieving its highest volume in three years. This surge is attributed to a mini refinance boom, marking a notable period of growth and opportunity for the company.

Key Drivers of the Surge

- Interest Rate Environment: The recent dip in interest rates has spurred a wave of refinancing activity, encouraging homeowners to refinance their mortgages.

- Market Position: UWM’s strategic positioning and competitive offerings have made it a preferred choice for many seeking refinancing options.

- Technological Advancements: The company’s investment in technology has streamlined the refinancing process, attracting more customers.

Impact on UWM

The mini refi surge has had a profound impact on UWM, leading to increased business volume and reinforcing its position as a leader in the mortgage industry.

- Increased Revenue: The surge has contributed to a significant boost in revenue, enhancing the company’s financial health.

- Market Share Growth: UWM has captured a larger share of the market, solidifying its competitive edge.

- Operational Efficiency: The increased volume has tested and proven the efficiency of UWM’s operational capabilities.

Future Outlook

Looking ahead, UWM is poised to continue leveraging its strengths to maintain momentum. The company is expected to focus on:

- Innovation: Continuing to innovate and improve its service offerings to attract more customers.

- Customer Experience: Enhancing customer experience to retain and grow its client base.

- Market Adaptation: Adapting to market changes to sustain growth and profitability.

Conclusion

UWM’s achievement of a three-year high in volume during the mini refi surge underscores its strategic acumen and operational excellence. By capitalizing on favorable market conditions and investing in technology, UWM has not only increased its market share but also set a strong foundation for future growth. As the company continues to innovate and adapt, it remains well-positioned to navigate the evolving mortgage landscape.